The healthcare.gov website. It’s not nearly as bad as people say, anyone reading this can get signed up and probably get cheap health care. You owe it to yourself to give it a try.

Editor’s Note: Because we’re in the annual enrollment period for Obamacare I’m going to write about health care. I don’t pretend to understand most of this stuff, in fact, much of what I know I learned from a fellow blogger. For that reason I encourage you to go to her blog and read one of her posts. Hopefully she can help clarify all this for you. Health Insurance and SD Domicile: Are There Any Options Left For Younger Fulltime RVers?

By Bob Wells –

I finally did it, I signed up for Health Insurance. I didn’t want to but the time has come and I just felt like had no choice. Obamacare is so confusing to me that last year I decided I would rather pay the penalty than try to figure it all out, so I didn’t sign up. But this year I’ve decided to bite the bullet and sign up for four main reasons.

This year I’m going to turn 60, and that is a very, very scary number. Most young men suffer from a feeling of invincibility: “I won’t get sick” and I think that describes me. However, the idea of turning 60 has a strong psychological power that’s broken through that. I’m finally ready to believe that statistically, in the next decade, I probably will get sick or injured. After that, when I’m in my seventies, a major illness is nearly a certainty. Health insurance is starting to sound pretty good.

The penalty is going up and it’ll cost me nearly as much as simply paying for insurance. There is a minimum penalty, which isn’t bad, but if you make more than the poverty level the penalty increases. Because I actually have a taxable income, my penalty could be fairly high.

I think I have a little better idea of what’s going on with health care. I’m actually a fairly slow learner and over the last year I’ve pieced together a basic understanding of Obamacare.

Right now through December 15, 2014 is the open enrollment period for Obamacare at healthcare.gov. If I’m going to do it, now is the time.

For all those reasons I’ve decided to get it and I just went through the process of signing up. I’m still no expert, but since it’s an important topic for all of us I thought I’d share my experience. But don’t take my word for everything you see here, do your own research and reach your own decision on what’s best for you.

I don’t want this to turn into a debate about Obamacare. Like it or not, it’s here to stay and my goal is to help people take advantage of it and not to fight about whether it’s right or wrong. Those comments belong on another website, not this one. Only helpful comments will be allowed.

Here are the basics as I understand them:

You have to have health insurance of some kind or pay a penalty. There are a few exceptions, but not many. If you’re covered at work or have Medicare or Veterans benefits, you’re covered already so you don’t need to do anything. This post only applies to people who are not covered by some form of health insurance.

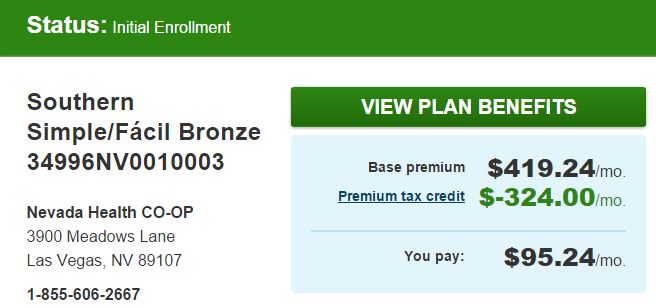

If you’re low income, the Federal government is offering subsidies to help you pay for health care. As usual, the less you make the more help they give you. But, don’t think you have to be at the poverty level to get it, you don’t. I make $26,000 a year and I qualified for a monthly subsidy of $324. I found a very cheap plan that cost $419 and so my monthly cost out of pocket is only $95. You might be throwing away money the government wants to give to you; you owe it to yourself to go to the site and find out.

To get the subsidies, you have to go to healthcare.gov and enroll. Like most of you, I was concerned that it was going to be a nightmare to get through it, but really, it was no big deal. You just answer all the questions, and do what you are told to do and before you know it you’ve set up an account. The hardest thing was they ask you a series of questions to verify that you really are who you claim to be. Some of them were negative, in other words they asked me a question and the answer was none-of-the-above. Apparently they are tied into the IRS database because they asked, “Which of these did you ever work for…” about an employer I had back in the 70s-80s. No one would know that but me.

Some of the questions they will ask is about your expected income for 2015. Since I’m self-employed, that was a little bit of guess-work, but I answered based on what I made last year and a little bit more. Once you’ve told them your expected income for 2015, they’ll tell you how much of a subsidy you qualify for, which in my case was $324 a month.

Once you’ve set up your account and determined your subsidy, you’ll see a button to take you to the Marketplace/Exchange where you chose an insurance plan and enroll in it. As far as I know, the only way to get the subsidies is to go through this process and chose one of the plans that they list for you. There are many other plans available off of the Exchange, but these are the only ones that you can get a subsidy for.

The plan I selected. You can see they take the government subsidy off and I don’t owe that, just my balance. Be aware that next year if my income is more than I expected, I’ll have to pay back the subsidy they over-payed.

The plan I selected. You can see they take the government subsidy off and I don’t owe that, just my balance. Be aware that next year if my income is more than I expected, I’ll have to pay back the subsidy they over-payed.

I chose a plan (you can see it in the picture above) and clicked on the “Pay Now” button, but it didn’t work. So I called them to find out what to do next. They said that they would mail out a copy of the policy and instructions on paying and I’d get it in a few days. I didn’t like that, I’d rather pay on-line and have it over with but I wanted this policy so I guess I’ll just have to wait.

Here are two important considerations when choosing an account.

The policy I selected. It has a very high deductible but that let’s me pay a very small monthly payment I can afford.

One, Consider a High Deductible Policy with a Health Savings Account

I can’t tell you what you should do but I wanted the cheapest policy I could get and that’s a High Deductible, Catastrophic care plan. I don’t want health insurance to cover my annual, non-emergency medical needs. If I decide I want them, I’ll just pay for them myself. What I do want is health insurance to cover the catastrophic care that will either kill or bankrupt me. Things like a major accident, heart disease, cancer, strokes or diabetes. Many of those things are fairly treatable, but the cost is astronomical and will ruin you.

I want insurance to cover those things and nothing else, so the plan I chose has a $6,250 deductible and it will cost me $95 a month after the government subsidy. I don’t ever plan to use it until a major disease or accident strikes. When, not if, that happens I want it to cover all of my costs and this plan does. After the deductible, it will pay 100 percent of all my costs, period. That’s exactly what I want.

The policy I selected has a very high deductible but that lets me pay a very small monthly payment I can afford.

One thing you might want to consider is getting an account that’s eligible for a Health Savings Account (HSA). The best way to think of an HSA is as an IRA that’s not for retirement, it’s for health costs. Once you have an eligible High Deductible Health Insurance Policy, you go to a bank and open an HSA. Every year you can deposit up to $3300 as a single or $6250 as a family. It’s main advantage is it’s tax-free. So if you deposit $2000 into your HSA, you get to take a $2000 deduction on your taxes even if you don’t itemize deductions.

Once the money is in the account it’s yours and you are in control of it. You can spend the money on any qualified medical expense and you will never pay taxes on it. Think about that, you never pay any taxes on that money. For some people, that’s a huge advantage.

But you can easily spend the money on non-medical costs. For example, let’s say your van breaks down and you have to take $1000 out to fix it. No problem. There are no penalties, but you will have to pay taxes on the $1000. So you deferred the taxes but didn’t avoid them. That means you have nothing to lose by putting the money in an HSA, but you may gain significant tax advantages.

Any interest the accounts earns stays in the account and is yours to use tax-free for medical expenses. At the end of the year all the money in the account rolls over to the next year. The idea is that you will build it up over the years until you have enough in it to cover the high deductible on your Insurance Policy. Since my policy doesn’t cover dental or glasses, I can use the money from the HSA to cover them, effectively making them a tax deduction whether I itemize or not.

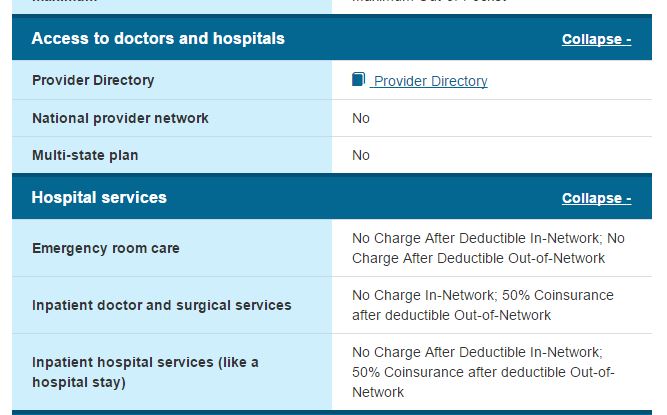

The Health Insurance Policy I selected doesn’t have a nationwide plan, but they do pay 50% of costs out-of-network which includes other state. They will also pay to get me back to Nevada if I’m out-of-state where I would have 100% coverage after I pay the deductible.

The Health Insurance Policy selected doesn’t have a nationwide plan, but they do pay 50 percent of costs even in other state.They will also pay to get me back to Nevada if I’m out-of-state where I would have 100% coverage after I pay the deductible.

Two, Look for a Nationwide Policy

Obamacare is complex for all of us, but if you live in a van or an RV it’s exceptionally complex. Why? Because most insurance companies only cover you if you go to a doctor in their network and their network is only in your home state. If you live full-time in one state and don’t travel much, that’s not a problem for you at all; you just find a doctor near you and stay with him. But because many of us travel a great deal, we may not often be present in our home state.

For example, many full-timers are residents of South Dakota, but can go years without being in the state. I’m a resident of Nevada, but I haven’t set foot in the state in over two years. If an insurance policy won’t cover me when I’m out of state, and I’m always out of state, it’s worthless to me.

I’m a Nevada resident, and none of the health insurance companies in Nevada offer a nation-wide plan. My problem is this is the only open-enrollment period for this year so I must enroll now and that doesn’t leave me time to move my state of residence. What I’ve decided to do is roll the dice and get the cheapest plan I can find under the pretty safe assumption I won’t need it this year. Then, this coming year, I’ll change my residency to a state that is RVer friendly and has a company in it that offers a Nationwide Health Insurance Policy.

There are three top states most of us choose as our residential domicile: South Dakota, Texas and Florida. Fortunately, both Texas and Florida are so large they have several good insurance companies that offer nationwide plans on the Exchange so I can get government subsidies.

Unfortunately, South Dakota (one of the most popular states for full-timers) does not. For that reason, many full-timers are planning to move their state of residence to either Florida or Texas, including me. I’m planning to visit my mom in February and while I’m there I may become a Florida resident. Escapees is now in Florida so I will use them as a mail service and my mom’s house as my residence. Then, next year during open enrollment, I’ll change insurance companies to a Florida plan. Florida has many policies on the Exchange that offer nationwide plans and they have just about the cheapest insurance in the country.

My standard advice has been to choose a state of residence based on how close it is to your normal travels, which is why I chose Nevada. They don’t have any income taxes or vehicle inspections which met my most basic requirements, but just as important, I’m usually within a few hours of it. For example, right now I’m near Quartzsite and I can be in Laughlin, Nevada in less than three hours. I spend a lot of my summers near Flagstaff, Arizona and that’s only 4 hours from Laughlin. So for about half my year I can easily get to Nevada for my health care needs.

What about the other half when I might be far away? The plan I chose pays half of your costs even when you’re out-of-network in another state, so no matter where I am in the country, I get some insurance. But they also pay to transport you to an in-network facility.

I wasn’t clear on exactly what that meant so I called and asked a representative and she told me it means that if I am in a different state, they will pay 100 percent of emergency room and 50 percent of everything else after the deductible. But, they also cover the costs of medical transport to get you back into the system.

For example, if I’m in an accident in Las Vegas and I’m taken to the nearest hospital that isn’t in the system, after I’m stabilized, they’ll pay to transport me to a hospital that is in the system where they’ll pay 100 percent. So I told the representative that last year I was in Alaska, and asked her if I had a heart attack while I was there, would they pay to transport me to an In-System facility in Nevada? Her answer was they would deal with it on a case-by-case basis depending on which would be the least expensive. If flying me back from Alaska was tremendously expensive, they would simply cover the cost of paying for my care in Alaska until I was able to get to Nevada on my own and see an In-Network doctor. While that isn’t a true nationwide plan, it may be very nearly as good. If it is, I might be content to remain a Nevada resident and keep this policy.

I know that’s a lot of information, but if you currently don’t have any health insurance I think you really should take a little time and go to healthcare.gov and set up an account. You might be very pleasantly surprised at how affordable health insurance can be with the governments subsidies.

Republished with permission from CheapRVLiving.com. Bob Wells has been a full-time Van Dweller for 12 years and love’s it. He hopes to never live in a house again.

Before you continue, I’d like to ask if you could support our independent journalism as we head into one of the most critical news periods of our time in 2024.

The New American Journal is deeply dedicated to uncovering the escalating threats to our democracy and holding those in power accountable. With a turbulent presidential race and the possibility of an even more extreme Trump presidency on the horizon, the need for independent, credible journalism that emphasizes the importance of the upcoming election for our nation and planet has never been greater.

However, a small group of billionaire owners control a significant portion of the information that reaches the public. We are different. We don’t have a billionaire owner or shareholders. Our journalism is created to serve the public interest, not to generate profit. Unlike much of the U.S. media, which often falls into the trap of false equivalence in the name of neutrality, we strive to highlight the lies of powerful individuals and institutions, showing how misinformation and demagoguery can harm democracy.

Our journalists provide context, investigate, and bring to light the critical stories of our time, from election integrity threats to the worsening climate crisis and complex international conflicts. As a news organization with a strong voice, we offer a unique, outsider perspective that is often missing in American media.

Thanks to our unique reader-supported model, you can access the New American journal without encountering a paywall. This is possible because of readers like you. Your support keeps us independent, free from external influences, and accessible to everyone, regardless of their ability to pay for news.

Please help if you can.

American journalists need your help more than ever as forces amass against the free press and democracy itself. We must not let the crypto-fascists and the AI bots take over.

See the latest GoFundMe campaign here.

Don't forget to listen to the new song and video.

Just because we are not featured on cable TV news talk shows, or TikTok videos, does not mean we are not getting out there in search engines and social media sites. We consistently get over a million hits a month.

Click to Advertise Here