By Glynn Wilson –

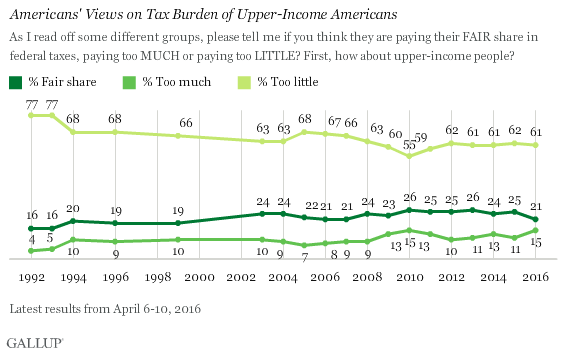

A majority of Americans agree that rich people and big corporations pay too little in taxes, according to the latest Gallup poll on the subject, just as Vermont Senator Bernie Sanders is making that case as a contender for the Dempocratic nomination for president.

Six in 10 Americans continue to believe that upper-income Americans pay too little in taxes, according to public surveys from Gallup.

“This attitude has been steady over the past five years, but is lower than in the early 1990s, when as many as 77 percent said those with higher incomes paid too little in taxes,” Gallup says in its analysis of the data.

Democratic presidential candidate Bernie Sanders has made the reduction of inequality the central motif of his campaign, saying, for example, that “the issue of wealth and income inequality is the great moral issue of our time. It is the great economic issue of our time, and it is the great political issue of our time.”

He has called for “higher income tax rates for the richest Americans.”

His Democratic Party opponent, Hillary Clinton, has followed his lead and called for the need to “reform our tax code so the wealthiest pay their fair share.”

As the debate in Brooklyn New York Thursday night demonstrated, again, chances are we would not be having this conversation about key economic domestic issues in the 2016 presidential election if he had not decided to run as a Democrat. Technically he is an independent, a self-described “democratic socialist,” who has caucused with the Democrats for many years. But due to the urging of groups like the Progressive Democrats of America, he decided to run for president this time as a Democrat, and it is paying off for him and the American people in a big way.

It is clear now that he has generated a massive amount of support from young Democrats and independents, many of whom were disgruntled with politics and may not have gotten involved in public life at all if not for the message Sanders is putting out.

To be fair and balanced, Gallup also talks about the position on taxes of the Republicans in the race, some calling for more simplified tax plans, which if passed, would reduce the income taxes all Americans pay, including the rich.

Ted Cruz says that under his tax plan, “All income groups will see a double-digit increase in after-tax income.”

Donald Trump’s plan would simplify the tax code into fewer tax brackets. Although it would reduce or eliminate “most deductions and loopholes available to the very rich,” the rich likely would pay less in taxes because upper-income taxpayers under Trump’s plan would have a lower tax rate.

If Americans vote on the basis of economics and tax policy, this should bode well for the Democratic nominee in the general election in November.

“The Democratic presidential candidates are the most in sync with overall public opinion on the issue of taxing the rich, given the significant majority who say upper-income Americans pay too little in taxes,” Gallup points out. “Americans’ attitudes on whether upper-income Americans pay too little in taxes are split along political lines.”

Three-quarters of Democrats say the rich pay too little, compared with less than half of Republicans. Independents mirror the national average.

Those with an annual income of at least $75,000 per year, Gallup’s highest income category for this analysis, have views that are broadly similar to those earning lower incomes.

A separate Gallup trend question addressing the issue of taxes paid by the well-to-do finds that a slight majority of Americans agree with the proposition that the government should redistribute wealth by “heavy taxes on the rich.”

Fortune Magazine first asked this question in the late 1930s, during the Great Depression, and at that point only about a third agreed. When Gallup updated the question in 1998, 45 percent agreed. Although the exact figures have fluctuated since, public opinion has been about evenly divided.

Most recently, in 2013, 2015 and this year, 52 percent of Americans say the government should redistribute wealth by taxing the rich.

Views on heavily taxing the rich to redistribute wealth are strongly related to political orientation, with a huge gap between Republicans (22% of whom agree with the idea) and Democrats (80%), and a similar gap between conservatives and liberals.

As household income rises, support for this idea drops, with those making at least $75,000 per year rejecting the idea of heavy taxes on the rich by a 59 percent to 40 percent margin, no surprise there.

Young people, who tend to skew more Democratic in orientation, are most likely of the age groups to favor the idea of taxing the rich.

A clear majority of Americans agree that money and wealth in the U.S. should be more evenly distributed among a larger percentage of people, as has been true since Gallup first asked this question in 1984.

The percentage agreeing was generally in the 60 percent range from 1984 through April 2008 and then dropped slightly in the fall of 2008 just before Barack Obama won the presidential election. The current 59 percent who agree with income redistribution is right at the average of what Gallup has found since 2009.

“Sanders has been most focused on the issue of income inequality in his campaign, and his position clearly strikes a highly responsive chord with his own partisans, although Democrats interviewed in this survey who support Clinton for their party’s nomination are little different on these measures from those who support Sanders,” Gallup says.

Cruz and Trump may find a similarly responsive chord among their partisans for their “lower all taxes” positions.

“Overall, the Democrats continue to have a more resonant position than Republicans with the general public on the use of taxes to help redistribute income and wealth,” Gallup concludes.

Other research shows, however, that Americans have become less likely to say the amount they personally pay in taxes is fair, and the Republican candidates’ calls for lowering taxes in general may be more in sync with the public’s views in general. Wealth inequality does not show up as an extremely high priority when Americans are asked about campaign issues, and relatively few Americans mention inequality or taxes as the most important problem facing the nation today.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 6-10, 2016, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is plus or minus 4 percentage points at the 95 percent confidence level. All reported margins of sampling error include computed design effects for weighting. Each sample of national adults includes a minimum quota of 60 percent cellphone respondents and 40 percent landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.